What Is Debt Negotiation?

Debt negotiation is the process where a Debt Management Specialist negotiates with one or more of your creditors to potentially reduce the amount of debt repayments.

Sometimes this results in reducing regular payments and even debt reductions.

This service can help people facing financial hardship and overwhelming debts by taking on the negotiation process for you, reducing stress, saving time, and working toward the best possible outcome.

You Don’t Have To Navigate Your Debt Alone

Our debt negotiation service helps reduce your financial stress by lowering or clearing your debt (where possible) and working out an affordable payment plan with your creditors. We’re by your side, and on your side – handling the hard conversations for you, so you can get back on your feet financially.

The benefit of Clear Path Debt Relief Strategies are:

Can reduce impact on your credit history

The hardship arrangement will appear for 12 months on your credit history and your payment history will appear for 24 months

Can stop interest and fees

Your interest and fees can often be stopped (dependent on individual’s situation). This means you can start repaying your debt, not just interest and fees.

Allows you to get a rental property or insurance

Rental agencies and insurance companies will often not approve applications when you have been in an insolvency arrangement. With an Informal Agreement, this isn’t a problem.

Generally minimises the effect on your job and employment contracts

Informal agreements created during the debt negotiation process do not affect your employment, because you’re not in a formal insolvency agreement.

* We advocate on your behalf to try to reduce or restructure your payments, but all final decisions rest with your creditors.

When Should You Consider Debt Negotiation?

If debt is causing you stress, or you’re struggling to keep up with current repayments, you may want to consider debt negotiation as a debt management option.

Particularly if you’re juggling multiple debts or facing relentless harassment from creditors. While it can be tempting to put your head in the sand, leaving your debts unaddressed can make the situation even worse – sometimes leading to more financial pressure, potential legal actions against you, or even threats to your home, belongings, job or business.

Debt negotiation helps you take control of your financial situation by working with creditors with the goal to stop interest and fees, simplify your repayments (so you can actually make them) and, most importantly, reduce your debt.

The sooner you act, the better your options will be for reducing debt and minimising the impact on your credit history.

Why Professional Financial Advocacy Matters When It Comes To Debt Management

Who you choose for your debt negotiation needs matters, and can have lasting impacts on your financial future.

When Debt Negotiation Isn’t Handled the Right Way:

- You could miss out on getting your debt reduced if it’s not handled delicately.

- Pushy or unprofessional tactics can ruin your relationship with creditors.

- Without knowing your rights, you might miss chances to negotiate better terms.

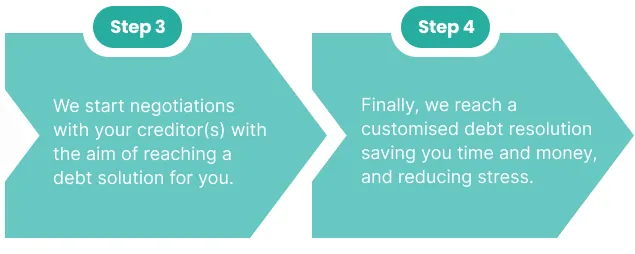

We Manage Debt Negotiations For You–Here’s What That Looks Like

Here's How We Work With You At Clear Path

Freeze, waive, or reduce your interest.

Negotiate with your creditors to give you affordable repayment plans that fit within your budget.

Provide an informal agreement as an alternative to entering Part 9 Debt agreements or Bankruptcy for you and your family.

We may investigate irresponsible lending to test the validity of your debt - potentially removing it altogether.

Having us on your side, rather than attempting to negotiate personally, can increase the likelihood of creditors continuing negotiations and reaching a final settlement that is in your favour, as they see you taking positive action towards your debts.

Ready To Leave Your Debt Stress Behind And Reduce Your Debt?

Book A Free Consultation.

- We’ll have a completely confidential discussion about your situation

- We go over your debts, creditors & financial circumstances

- We give you an honest assessment of what's possible in your situation, and confirm whether you qualify for debt negotiation services

- We will always treat you with compassion, care and respect.