Debt Relief for:

Credit Cards

Personal Loans

Car Loans

Home Loans

Small Business Debts

ATO Debts

We will negotiate with your creditors to reduce your debts, pause interest, and create repayment plans you can actually afford.

So you can:

Reduce Harassing Phone Calls

Lessen Financial Stress

Minimise Impact On Your Credit File

Create A Do-able Debt Re-payment Plan

Hand Over The Hard Conversations To Us

Relax–we Manage Debt Negotations For You

Loan Repayment Calculator

FORTNIGHTLY REPAYMENT

Estimates only. Does not include fees, insurance, or rate changes.

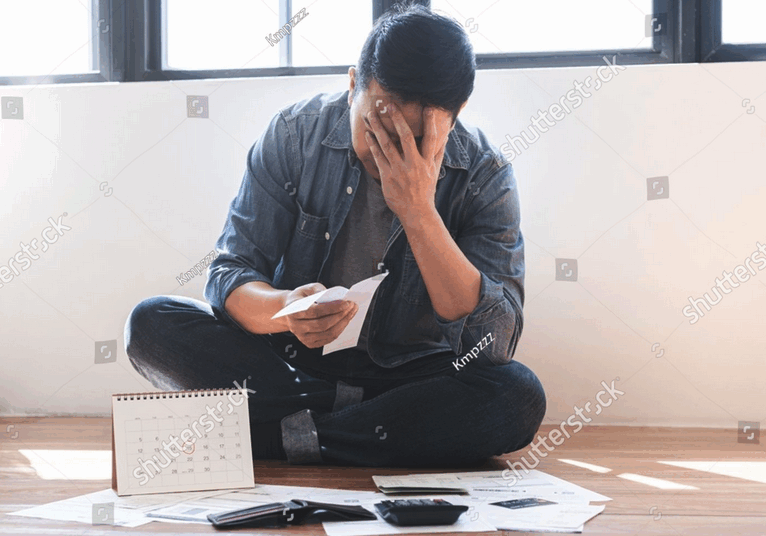

Does this feel all too familiar?

- You’re buried under a mounting pile of home/utilities bills, car repayments, mortgage arrears or credit card bills.

- You’re struggling to make the minimum payments.

- You’re being harassed by Debt Collectors and feeling anxious every time your phone rings.

- You’re experiencing stress every single day – feeling as if debt is hurting your relationships, health, work performance, and daily life.

You’re not alone…

More and More Australians are facing money problems.

Whether it's a result of job loss, relationship breakdown, the rising cost of living, a business closing, illness or injury, or simply poor budgeting – financial stress affects real people daily. And, sometimes, their debt builds up and becomes unmanageable.

We know that one of the hardest things to do when debts, bills and interest start piling up is to ask for help.

But asking for help – rather than waiting it out and hoping things will magically get better – is the best thing you can do.

How We Help You Take Control Of Debt

How We Help You Take Control Of Debt

Clear Path Debt Relief assists with trusted debt negotiation and informal debt solutions nationwide.

You don't have to face this alone – we’ll guide you every step of the way.

Our team will negotiate on your behalf – working with you and your creditors in an attempt to reduce your debt amounts, pause or stop interest and fees, and create an affordable, realistic plan to repay your debts.

We help you take control of your debt without restoring to bankruptcy, debt consolidation and Part 9 Agreements – all of which can impact your credit rating and financial security long term.

Why choose Clear Path’s Debt Management services